income tax calculator philippines

Tax Calculator Philippines is an online calculator you can use to easily compute your income tax and other miscellaneous expenses that comes with it. Philippines Salary Calculator 2022.

Table Take Home Pay Under 2018 Tax Reform Law

Interest on foreign loans.

. Income from 40000001. Majority of the waged workers who are earning 21000 a month or less will be exempted from tax liabilities while those who are earning more are subject to a. Maaring magbayad ang mga propesyunal na kumukita ng 3 milyon pababa ng 8 na buwis sa lahat ng kabayarang siningil ng propsesyunal sa halip na magbayad ng personal income.

Its online income tax calculator is quite similar in terms of features and functions to the DOF tax calculator except that the former provides more detailed information. Income Tax facts in Phillippines you should know. The Annual Wage Calculator is updated with the latest income tax rates in Philippines for 2022 and is a great calculator for working out your income tax and salary after tax based on a Annual income.

The Annual Wage Calculator is updated with the latest income tax rates in Philippines for 2021 and is a great calculator for working out your income tax and salary after tax based on a Annual income. Sweldong Pinoy is a salary calculator for Filipinos in computing net pay withholding taxes and contributions to SSSGSIS PhilHealth and PAG-IBIG. To access Withholding Tax Calculator click here.

Income from 200000001. Consult a tax professional for any tax concerns. This tool is built so more Filipinos are more aware of the salary or monthly income tax they are paying.

Ang tax calculator na ito ay pawang para sa mga sumasahod lamang dahil sa ibang sistema ng pababayad ng buwis para sa mga self-employed at propesyunal tulad ng mga doktor. Results do not necessarily reflect actual taxable income. Since your taxable income is 2200245 the computation will be as follows.

Income Tax Taxable Income 12 X Y 12 Where X is the minimum value of the particular salary range and Y is the respective percentage. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Income from 25000001.

Review the full instructions for using the Philippines Salary After Tax Calculators which details. How to use BIR Tax Calculator 2022. For inquiries or suggestions on the Withholding Tax Calculator you may e-mail contact_usbirgovph.

How To Compute Tax Refund in the Philippines Formula. This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income. An online tax calculator in the Philippines like Taxumo is a reliable resource.

Tax rate Income tax in general 25 beginning 1 January 2021. The calculator is designed to be used online with mobile desktop and tablet devices. Income from 80000001.

Compensation Income for employees The employee has a basic salary of Php 30000 monthly or Php 360000 annually. The Tax Caculator Philipines 2022 is using the latest BIR Income Tax Table as well as SSS PhilHealth and Pag-IBIG Monthy Contribution Tables for the computation. General Formula for computing annual income tax refunds.

In most places income tax will generally increase with higher income and employers will automatically deduct and withhold income tax from paychecks. Highlights of the FIRB Accomplishment Report CY 2014. When it comes to freelance tax in the Philippines your annual and quarterly income taxes are required to be filed and paid based on tax income rates ranging from 5-32 prescribed by the BIR.

Procedures for Availment of Tax Subsidy of GOCCs. Calculate your income tax in Philippines salary deductions in Philippines and compare salary after tax for income earned in Philippines in the 2022 tax year using the Philippines salary after tax calculators. The Philippines Tax Calculator is a diverse tool and we may refer to it as the Philippines wage calculator salary calculator or Philippines salary after tax calculator it is however the same calculator there are simply so many features and uses of the tool Philippines income tax calculator there is another that we refer to the calculator functionally rather than by a.

Philippines Non-Residents Income Tax Tables in 2020. The calculator was created as an aid to compute your income tax. The calculator is designed to be used online with mobile desktop and tablet devices.

The countrys proposed tax reform package under the administration of President Rodrigo Duterte aims to bring down the tax liabilities of most taxpayers in the country. Magnitude of Tax Subsidy Grant and Utilization By Recipient 2006-2015. We are aiming to give you the precise computation as possible but as you have known tax computations are changing base on other.

Review the full instructions for using the Philippines Salary After Tax Calculators which details. Taxation rates vary wildly by location and the characteristics of each taxpayer. To estimate the impact of the TRAIN Law on your compensation income click here.

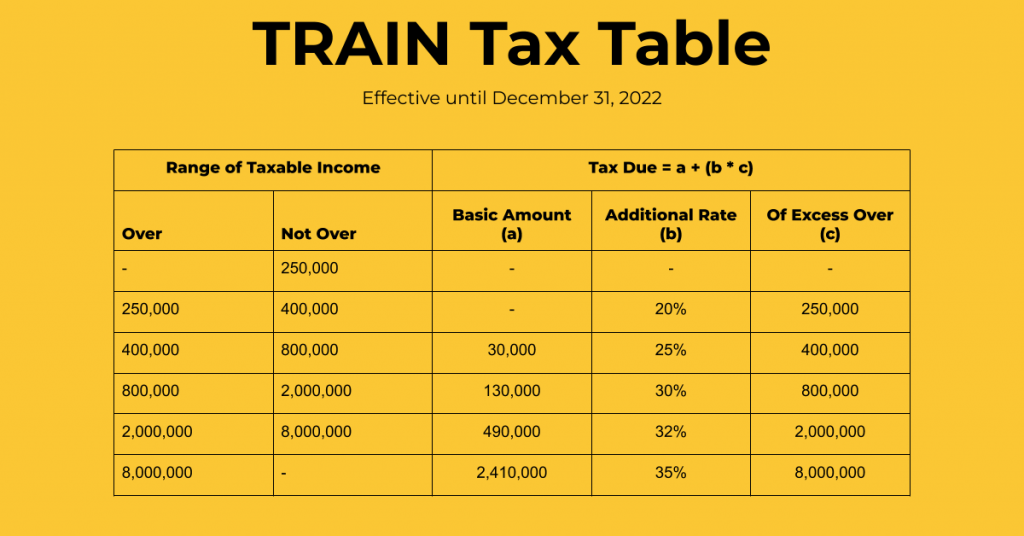

The National Tax Research Center NTRC is an agency under the DOF that conducts research in taxation to improve the tax system in the Philippines. Select a tax calculator from the list below that matches how you get paid or how your salary package is detailed. 6 rows The compensation income tax rate in The Philippines is progressive and ranges from 0 to 35.

Tax Due Prepaid Tax Payments Tax Payable or Refund. Dont fret because there are tax calculators in the Philippines that are reliable sources on the computation of your personal income tax. Income tax is a tax that is imposed on the income or profits earned by individuals and entities.

Income Tax 2200245 12 250000 020 12 2640294 250000 020 12 280588 12 Income Tax 23382. Quarterly taxable net income is the differentiating factor. Dividends from domestic corporations if the country in which the foreign corporation is domiciled does not impose income tax on such dividends or allows a tax deemed paid credit of 15 or the difference ie 10.

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

Tax Calculator Compute Your New Income Tax

How To Compute Quarterly Income Tax Return Philippines 1701q Business Tips Philippines

Tax Calculator Compute Your New Income Tax

2022 Updated Bir Form 1701 How To File Pay Annual Income Tax

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Tax Calculator Philippines 2022

How To Calculate Foreigner S Income Tax In China China Admissions

Excel Formula Income Tax Bracket Calculation Exceljet

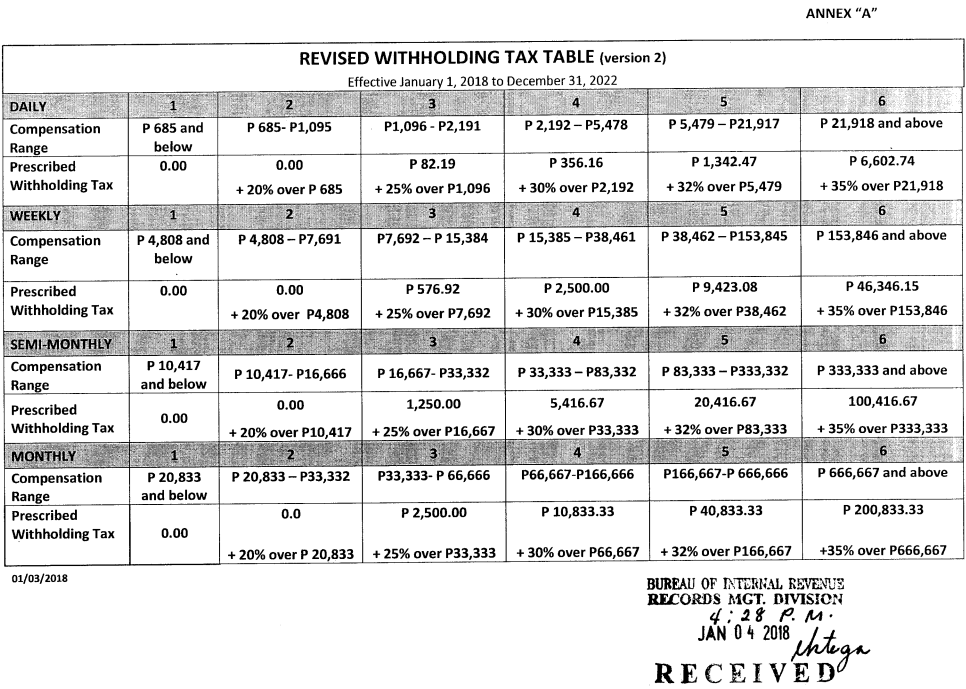

Revised Withholding Tax Table Bureau Of Internal Revenue

2022 Bir Train Withholding Tax Calculator Calculator

2022 Bir Train Withholding Tax Calculator Tax Tables

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

Tax Calculator Compute Your New Income Tax

Infographic Corporate Tax And Value Added Tax In Indonesia

How To Compute Philippine Bir Taxes

How To Compute Your Income Tax In The Philippines Cashmart Ph